Tax brackets for paychecks

Ad Get Guidance in Every Area of Payroll Administration. All Services Backed by Tax Guarantee.

Paycheck Calculator Take Home Pay Calculator

Also deducted from your.

. The Global Solution for Payroll Professionals. Some states follow the federal tax. What Are the Trump Tax Brackets.

Many workers noticed changes to their paychecks starting in 2018 when the new tax rates went into effect. Median household income in 2020 was 67340. The Global Solution for Payroll Professionals.

However they dont include all taxes related to payroll. Ensure Comprehensive Payroll Compliance. Or call us at 901-360-0711 and we will walk you through the process over the phone to help you enter the data and provide that extra level of comfort.

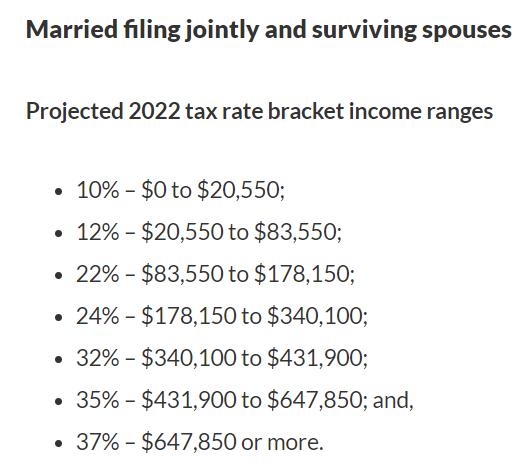

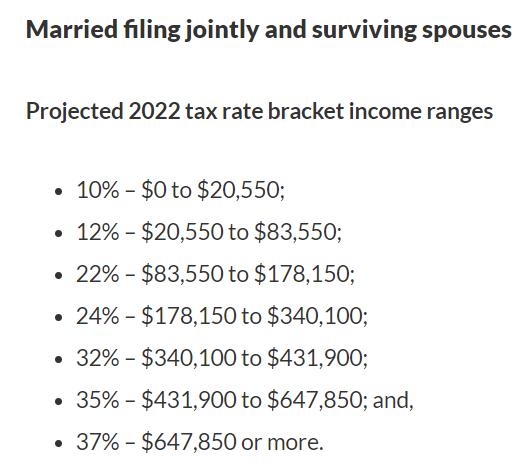

Discover Helpful Information And Resources On Taxes From AARP. To calculate your federal withholding tax find your tax status on your W-4 Form. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

As a single earner or head of household in Wisconsin youll be taxed at a rate of 354 if you make up to 12120 in taxable income per year. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. The amount of income tax your employer withholds from your regular pay.

Ensure Comprehensive Payroll Compliance. Ad Payroll So Easy You Can Set It Up Run It Yourself. Find a Dedicated Financial Advisor Now.

The state tax year is also 12 months but it differs from state to state. Federal income tax rates range from 10 up to a top marginal rate of 37. Federal Paycheck Quick Facts.

Do Your Investments Align with Your Goals. Ad Compare Your 2022 Tax Bracket vs. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

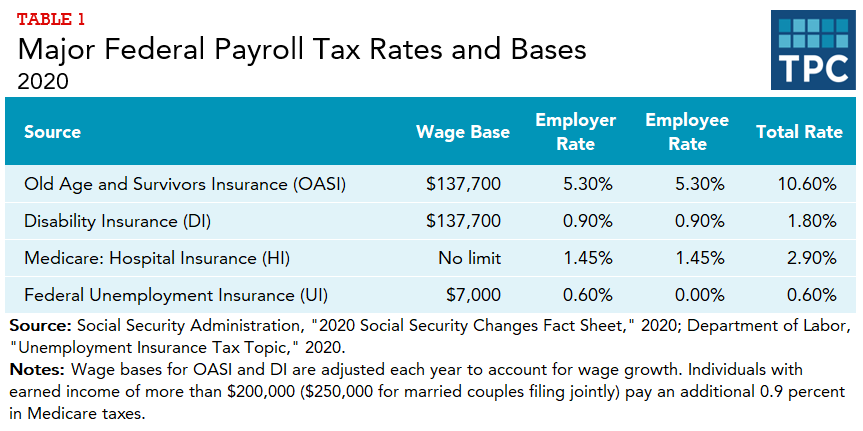

Ad Get Guidance in Every Area of Payroll Administration. If you compute payroll manually your employee has submitted a Form W-4 for 2020 or later and you prefer to use the Wage Bracket method use the worksheet below and the Wage Bracket. FICA taxes are commonly called the payroll tax.

All you need to do is enter payroll data. Based on the number of withholding allowances claimed on your W-4 Form and the amount of. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Singles and heads of household making. Your 2021 Tax Bracket To See Whats Been Adjusted.

For employees withholding is the amount of federal income tax withheld from your paycheck. See where that hard-earned money goes - Federal Income Tax Social Security and. FICA taxes consist of Social Security and Medicare taxes.

There are seven federal income tax rates in 2022.

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Paycheck Calculator Online For Per Pay Period Create W 4

2022 Federal State Payroll Tax Rates For Employers

Federal Income Tax Fit Payroll Tax Calculation Youtube

How To Calculate Federal Income Tax

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Calculation Of Federal Employment Taxes Payroll Services

Federal Withholding Calculator Store 51 Off Www Ingeniovirtual Com

Payroll Tax What It Is How To Calculate It Bench Accounting

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

2 My Paycheck My Future Self Portfolio

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Calculation Of Federal Employment Taxes Payroll Services

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

How To Calculate Payroll Taxes Methods Examples More

Irs New Tax Withholding Tables